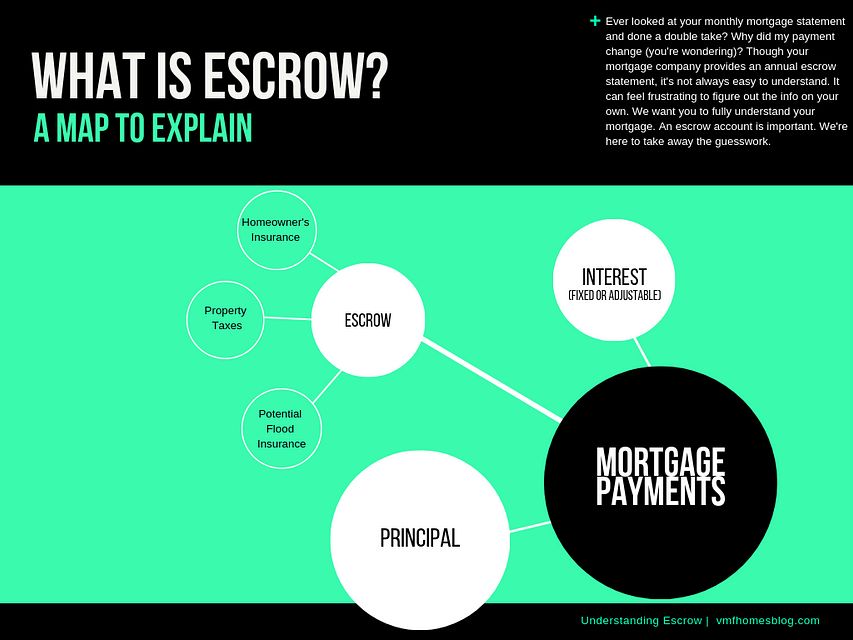

Escrow is the final piece to understanding what makes up a mortgage.

Escrow is the final piece to understanding what makes up a mortgage.

Additional funds collected by your lender with your mortgage payment that is set aside to pay your property taxes, home insurance, and flood insurance if you have it.

Many lenders do require escrow for taxes and home insurance. Ask your lender what your options are on your loan.

It keeps you from having to save separately for large bills. It allows you to not have to worry about due dates, and rest assured that the payments will be made.

Usually, your monthly escrow payment is divided by the estimated annual costs for property taxes and insurance by 12. Then, a cushion amount is added to help make sure there will be enough if the bills go up

Sometimes called an escrow review, this is when your lender or mortgage servicer reviews your escrow account yearly. They compare the collected amount to your current bills for taxes and insurance to be sure the monthly payment is correct.

Escrow does not change the amount of your mortgage, but it may change your monthly payment if your property tax or insurance bills go up or down.

The money is used to pay the property tax and insurance bills when they are due. If there is too much or not enough money when your mortgage company does the escrow analysis, they will contact you to review your options.