Many people blame their lack of savings on their financial situations. It's a common belief that only the rich can save because they have extra. But saving is not about excess - it's about making room. That means that saving is available to most everyone.

Certainly, it's difficult when funds are low, but saving may help you prioritize and get back on track. The best saving is done without you really realizing it. Check out the ideas below to get started!

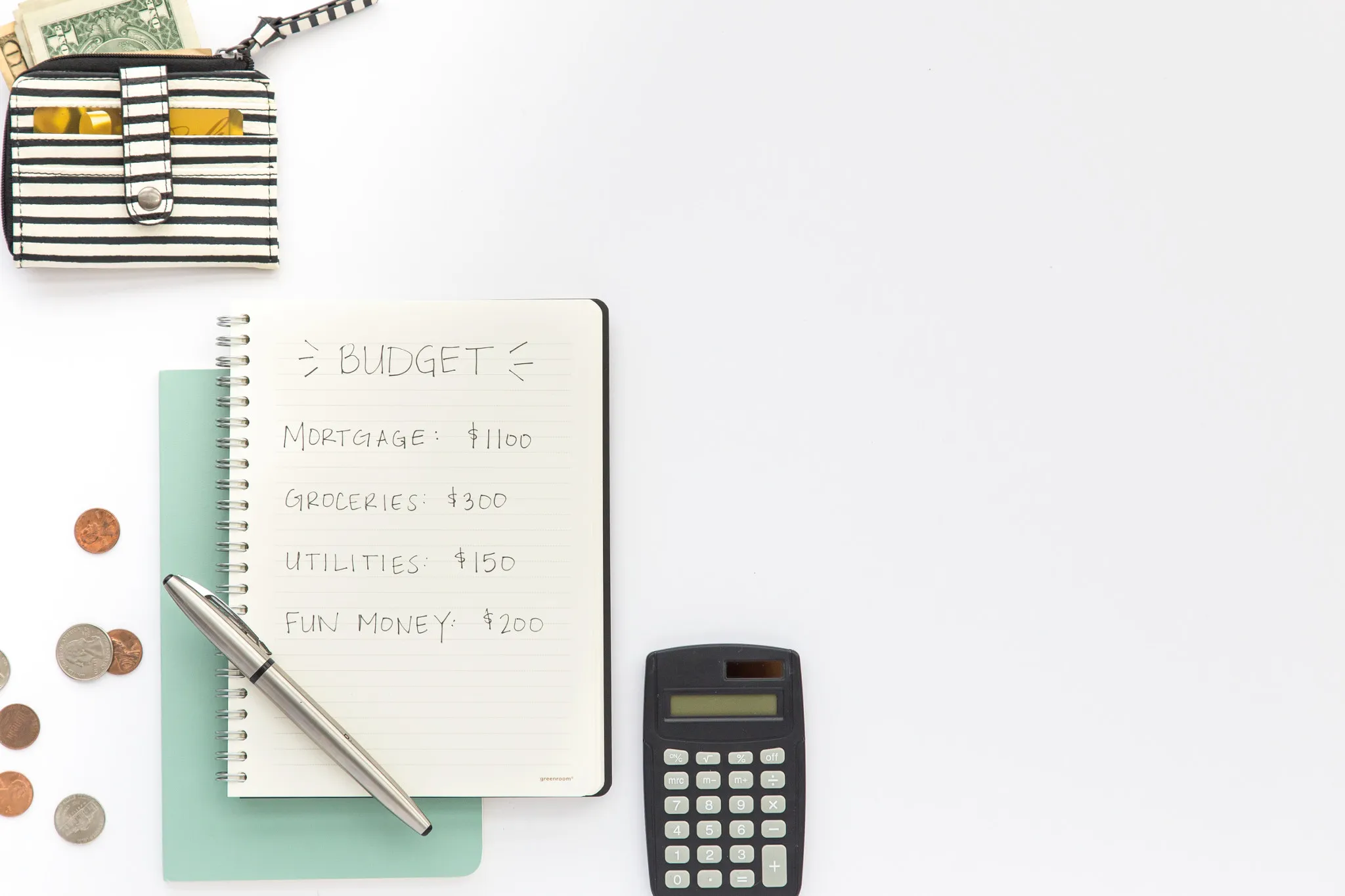

Let us help you with your budget if you don’t have one! Don’t read any further until you have made one! Start Your Budget Today

Think specific and tangible. We recommend monthly goals that you evaluate and renew at the end of each month. Write them down.

It’s often hard to save with one account, but if you open up a savings account at another bank it’s easier to forget about it and let the funds add up.

You can also open a checking account to use for big purchases only and use your other bank card for daily needs. You’ll find you can save for yearly needs and things like a down payment all at once.

It’s likely you have auto-pay, why not have direct deposit? Even better, why not split up your direct deposit if you can. Some companies will allow you to direct deposit into more than one account and select how much you’d like to go to each account. Select a certain amount of your paycheck to filter into your savings account. Yes, 10 dollars every paycheck makes a difference. If your place of work doesn’t do this you can do it manually with cash.

Coins are all but forgotten in society. We look at change like the annoying jingle in our pocket and because of that we end up missing it’s worth. Keep your spare change in a big jar, and put it into your savings account yearly.

We’d encourage you to leave your savings alone, but we understand that sometimes you need to dip into them. Just be sure to only do so when you really need to. Also, think of how to make up what you spent. Only pull from savings for medical or family emergencies – no leisure buys.

Perhaps, these ideas still seem hard to do. No worries. If things are tight consider the following: place 10 percent of your tax return in savings, get quotes on a cheaper phone bill and save the difference, cut the internet for a while and visit a library, save half that birthday/holiday cash, ask for cash for the remainder of gift cards, sell that thing you don’t need and give your savings some love. These are just to get you started!

This year is shaping up to be quite the year for your wallet! You can follow all the disciplines listed above. Anyone can. The difference isn’t your income – it’s making room in your budget to succeed.